By Rick Clay

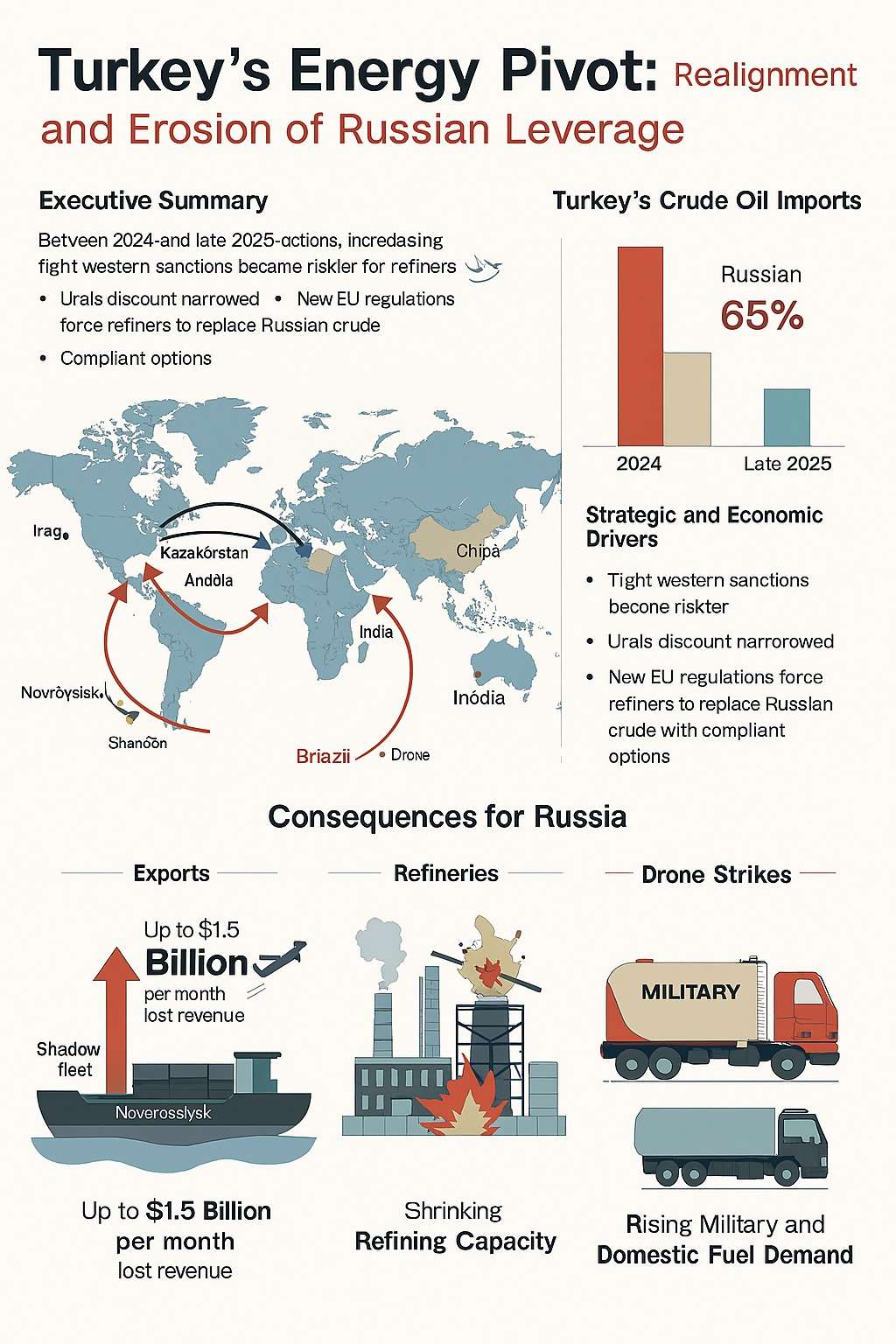

Between 2024 and late 2025, the global energy landscape has undergone a dramatic recalibration, driven in large part by the Trump Administration’s aggressive sanctions architecture targeting Russia’s oil sector. Through a coordinated campaign of financial restrictions, entity blacklisting, and enforcement of maritime price caps, the administration has successfully disrupted Russia’s crude exports to its three largest customers: Turkey, China, and India.

Turkey, once dependent on Russia for nearly 65% of its oil imports, has slashed that figure to 47% and continues to diversify toward Iraqi, Kazakh, Brazilian, and Angolan sources. China’s state-owned oil majors have suspended seaborne Russian crude purchases, while independent “teapot” refineries face blacklisting and operational strain. India, under pressure from U.S. Treasury enforcement and tightening insurance rules, has reduced its intake of Russian barrels and pivoted toward Middle Eastern alternatives.

These shifts are not isolated, they reflect the strategic success of U.S. policy in fragmenting Russia’s post-Ukraine energy alliances. The result: Russia faces up to $1.5 billion per month in lost revenue, declining refining capacity due to Ukrainian drone strikes, and surging domestic military fuel demand amid wartime escalation. Meanwhile, Turkey and China are repositioning as compliant, diversified energy hubs, reshaping the balance of power in the Black Sea, Mediterranean, and Indo-Pacific.

This quiet energy pivot, engineered through sanctions, diplomacy, and enforcement is one of the most consequential stories in global trade today. It marks a turning point in the economic containment of Russia and the strategic reordering of energy flows across Eurasia.

In 2024, Turkey ranked as Russia’s third-largest oil customer, trailing only China and India. Russian Urals crude accounted for nearly two-thirds of Turkey’s total oil imports, with Tüpraş and SOCAR STAR absorbing the bulk of these volumes. This relationship was economically advantageous for both sides, Russia secured a reliable Mediterranean outlet, while Turkey benefited from discounted Urals barrels and proximity to Russian ports.

However, the geopolitical landscape shifted dramatically in 2025. New U.S. sanctions targeted Rosneft, Lukoil, and dozens of subsidiaries, threatening secondary penalties for foreign entities transacting with blacklisted firms. Simultaneously, the price advantage of Urals crude eroded, and EU regulations tightened around the origin of refined fuels. These pressures forced Turkish refiners to reconsider their sourcing strategies.

Turkey’s pivot away from Russian crude is not reactive it is a calculated, multi-dimensional response to evolving geopolitical, economic, and regulatory pressures. The decision to diversify oil imports reflects a convergence of strategic imperatives that go beyond price and supply logistics. Three primary drivers underpin this shift:

1. Western Sanctions and Compliance Risk

The 2025 expansion of U.S. sanctions against Russian energy firms particularly Rosneft, Lukoil, and their subsidiaries has introduced a new layer of risk for global refiners. These sanctions not only blacklist parent companies but also target upstream and midstream entities responsible for over 40% of Russia’s hydrocarbon output. For Turkish refiners, the implications are clear: continued reliance on Russian crude exposes them to secondary sanctions, reputational damage, and potential exclusion from Western financial systems.

SOCAR STAR, which exports refined fuels to the EU, faces heightened scrutiny. EU regulations now require full traceability of feedstock origin, and any linkage to sanctioned Russian entities could jeopardize market access. In this context, compliance is not just a legal obligation, it is a strategic necessity.

2. Erosion of Urals Price Advantage

Historically, Russian Urals crude offered Turkish refiners a compelling economic proposition: proximity, compatibility, and deep discounts. But by late 2025, the discount has narrowed significantly, eroding its competitive edge. As Brent-linked alternatives from Iraq, Kazakhstan, Brazil, and Angola become more price-competitive, the economic rationale for importing Russian oil weakens.

Moreover, the logistical costs of handling Russian crude, especially amid tightening insurance and shipping restrictions—have increased. The net result is a recalibration of procurement strategy, where non-Russian grades offer better value with lower compliance risk.

3. EU Fuel Export Integrity

Turkey’s strategic role as a refined fuel supplier to Europe hinges on its ability to deliver compliant products. EU importers now demand assurance that diesel, gasoline, and jet fuel are not derived from sanctioned Russian crude. This requirement has forced Turkish refiners to audit their supply chains and reconfigure their feedstock mix.

Tüpraş, for example, has begun sourcing Iraqi grades that match Urals in sulfur content and density, allowing for minimal disruption to refinery operations while ensuring regulatory compliance. SOCAR STAR has secured multiple non-Russian cargoes for December delivery, signaling a structural shift in its sourcing model.

Together, these drivers form a coherent strategic logic: Turkey is not merely reacting to external pressure it is proactively repositioning itself as a compliant, diversified, and geopolitically agile energy hub.

Iraqi crude has become a cornerstone of Turkey’s diversification strategy. In November 2025, Turkey imported 141,000 barrels per day of Iraqi oil—up from 99,000 bpd in October and well above the annual average. Tüpraş has increased intake of Iraqi grades compatible with Urals refining configurations, while SOCAR STAR secured multiple Iraqi cargoes for December delivery.

This shift not only fills the operational gap left by Russian volumes but also strengthens Turkey’s energy ties with Iraq, potentially catalyzing broader infrastructure and diplomatic cooperation.

Russia’s energy sector, long the backbone of its fiscal stability, is now under siege. In September 2025, fossil fuel export revenues fell to €546 million per day, the lowest since the full-scale invasion of Ukraine began. Oil and gas revenues for the federal budget dropped 26% year-on-year, with seaborne oil product exports declining 13% month-on-month and crude volumes slipping 9%.

The loss of Turkish and Chinese demand compounds this pressure. Turkey’s pivot alone could cost Moscow up to $1.5 billion per month, while China’s suspension of seaborne Russian crude purchases, especially by state-owned firms—has disrupted up to 1.4 million barrels per day of maritime flows. These twin retreats fracture Russia’s post-Ukraine energy alliances and expose its overreliance on shadow fleets and discounted pricing.

Sanctions have also slashed Russia’s pricing power. Enforcement of the newly lowered $47.6 per barrel price cap could reduce revenues by €1.53 billion in a single month, while a hypothetical $30 cap would cut earnings by 36%. Even pipeline exports—once a stable fallback—have seen marginal declines.

Ukraine’s long-range drone campaign has added a kinetic layer of disruption. Since mid-2025, Ukrainian forces have launched over a dozen deep strikes per month on Russian refineries, targeting facilities in Ryazan, Belgorod, Volgograd, Samara, and Sochi. These attacks have reduced Russia’s refining capacity by 30%, according to Western intelligence.

The impact is twofold:

• Domestic fuel shortages have emerged, with gasoline rationing reported in several regions. Russia’s ability to meet internal demand—especially for civilian transport and agriculture—is increasingly strained.

• Military fuel demand is surging, as Russia intensifies operations in eastern Ukraine. The Kremlin has prioritized fuel allocation to frontline logistics, armored divisions, and drone production, diverting supply from civilian sectors.

Despite idle capacity and fuel stockpiles cushioning some losses, the strikes have forced Russia to import refined products and curb exports, undermining its energy sovereignty. The Ryazan refinery Russia’s fourth-largest was forced to halt crude distillation entirely after a direct hit.

Russia’s energy war chest is shrinking just as its military expenditures rise. The convergence of sanctions, market loss, and kinetic strikes is not merely economic, it is strategic. Moscow’s ability to fund its war effort, stabilize domestic markets, and project energy influence is eroding in real time.

• Turkey’s Autonomy and Influence: By diversifying its energy sources, Turkey enhances its strategic autonomy and positions itself as a compliant, reliable hub for European fuel flows.

• Black Sea and Mediterranean Dynamics: The pivot weakens Russia’s leverage in the region and amplifies Turkey’s role as a geopolitical fulcrum.

• Global Energy Flows: The rerouting of crude—from Novorossiysk to Basra, Luanda, and Santos—signals a broader fragmentation of traditional supply chains.

China’s energy relationship with Russia, once a cornerstone of Moscow’s sanctions evasion strategy, is now under strain. In late 2025, following sweeping U.S. sanctions targeting Rosneft, Lukoil, and affiliated entities, China’s state-owned oil majors (Sinopec, PetroChina, CNOOC, Zhenhua Oil) suspended purchases of seaborne Russian crude. This move signals a broader recalibration, as Beijing weighs compliance risk against its strategic ties with Moscow.

The impact is especially acute among China’s independent “teapot” refineries, which account for roughly one-quarter of the country’s processing capacity. These small, privately owned refiners, primarily located in Shandong province, have long relied on discounted Russian, Iranian, and Venezuelan crude. But recent sanctions have blacklisted several teapots and port operators, triggering a sharp drop in Russian oil flows and forcing operational cutbacks.

• Run rates among teapots fell below 45% in early 2025, the lowest in two years, before recovering slightly in March amid seasonal demand and non-sanctioned tanker availability.

• Sanctions have disrupted up to 1.4 million barrels per day of maritime Russian oil imports to China, leaving Moscow with unsold volumes and deepening its fiscal exposure.

• Pipeline-transited oil (900,000 bpd) remains unaffected, but the loss of seaborne flexibility undermines Russia’s pricing power and market agility.

China’s pivot is not absolute, some refiners continue to explore shadow fleet workarounds, but the strategic signal is clear. Beijing is recalibrating its energy posture to avoid secondary sanctions, preserve access to Western financial systems, and insulate its state firms from reputational risk.

This shift compounds the pressure already facing Russia from Turkey’s retreat. Together, these moves represent a fracturing of Moscow’s post-Ukraine energy alliances, with implications for global oil flows, regional diplomacy, and the Kremlin’s economic resilience.

Turkeys and China’s retreat from Russian oil is not merely a shift in procurement, it is a strategic rupture in Moscow’s post-Ukraine energy architecture. Driven by the Trump Administration’s sanctions campaign and reinforced by compliance imperatives, market dynamics, and kinetic pressure from Ukrainian drone strikes, this pivot marks a decisive weakening of Russia’s global energy leverage.

Turkey’s diversification toward Iraqi, Kazakh, Brazilian, and Angolan crude has redefined its role as a compliant, autonomous energy hub in the Mediterranean. China’s recalibration—especially the suspension of seaborne Russian crude by state-owned firms and the disruption of teapot refinery operations—signals a broader risk-averse posture among major importers. India’s quiet reduction in Russian intake further underscores the reach of U.S. enforcement.

Meanwhile, Russia faces cascading losses: up to $1.5 billion per month in forfeited revenue, shrinking refining capacity, rising military fuel demand, and eroding pricing power. The convergence of sanctions, market fragmentation, and battlefield disruption is not just economic—it is existential.

This energy realignment is one of the most consequential and underreported shifts in global trade. It is reshaping the balance of power across the Black Sea, Mediterranean, and Indo-Pacific, and it offers a blueprint for strategic containment through economic pressure. The question now is not whether Russia’s energy dominance is fading, but how fast, and how far.