By Rick Clay

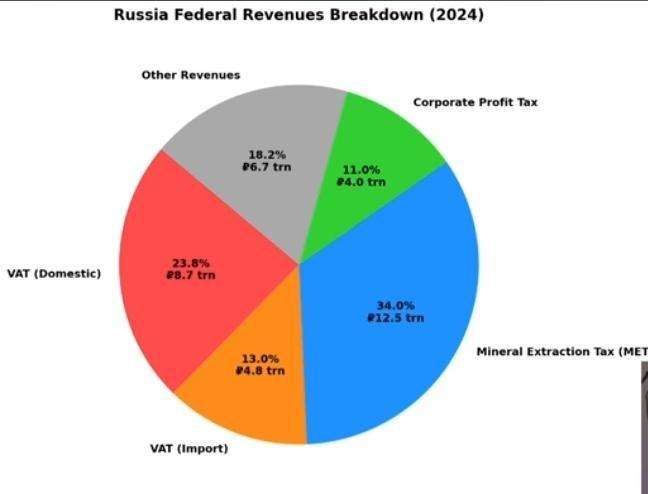

Russia’s 2024 federal revenue, estimated at ₽36.7 trillion, is overwhelmingly VAT-dependent. Mineral extraction VAT effectively a consumption tax on oil, gas, and coal—accounts for 34.0% of total revenue (₽12.5T), while domestic VAT contributes 23.8% (₽8.7T) and import VAT adds another 13.0% (₽4.8T). Together, these VAT streams comprise nearly 70% of Russia’s fiscal intake, up from just 37% in 2020. Corporate profit tax has declined to 11.0% (₽4.0T), and “Other Revenues” have collapsed from 28% to 18% over the same period, underscoring the narrowing fiscal base and growing reliance on regressive taxation.

In response to mounting fiscal pressure, Russian authorities have raised the corporate profit tax rate to 25% in 2025, placing Russia 12th globally higher than the U.S., China, and the UK. A further VAT increase from 20% to 22% is proposed for 2026, with expanded coverage to firms earning over ₽10M annually, down from ₽60M. A one-time 10% levy on excess bank profits is expected to raise ₽200B, but this remains insufficient against a projected ₽5–8T deficit. These measures reflect a war economy under strain, where military and social spending remain politically untouchable, forcing the Kremlin to squeeze the private sector and consumers.

Russia’s fiscal trajectory between 2025 and 2027 hinges on its ability to manage widening deficits amid war-driven spending and declining revenue elasticity. In the baseline scenario, the government maintains the current VAT rate and raises corporate tax to 25%, triggering a ₽5T deficit. Moscow responds with conventional tools—domestic bond issuance and targeted subsidies—but these offer limited breathing room and risk compounding inflation. In the case of stress, VAT rises to 22%, pushing the deficit toward ₽8T. The Kremlin may monetize the ruble, draw down reserves, and impose capital controls, signaling acute liquidity stress. In the crisis scenario, a VAT hike to 24% and corporate tax at 28% drive the deficit beyond ₽10T, forcing emergency exemptions, forced lending, and quasi-confiscatory tactics reminiscent of late-Soviet fiscal desperation. This scenario risks systemic instability, especially if paired with sanctions escalation or commodity price shocks.

VAT increases trigger multi-stage inflation. Every 1% hike translates to roughly 1.5–1.8% CPI growth. Wage growth lags, especially in defense-heavy sectors, compressing real income and fueling underground economy expansion. At 22% VAT, CPI could rise 3.5% with a 2% real wage decline; at 24%, inflation could breach 6.5%, with real wages down 4.5%—a politically volatile threshold. The substitution curve steepens as low-income households exit formal markets, middle-income consumers retrench, and high-income actors hedge abroad. Informal fuel markets expand, discretionary consumption contracts, and domestic brands gain share—but at the cost of quality and competitiveness.

Investor sentiment deteriorates as tax burdens rise, and policy opacity deepens. Foreign capital retreats, domestic firms face margin compression, and expansion stalls. Russia risks slipping from stagnation into contraction, with systemic banking stress looming. Politically, the VAT hike is deeply unpopular. Consumer discontent over regressive taxation pressures the Kremlin, and while subsidies and social transfers have begun, they may prove fiscally unsustainable. Demands for broader exemptions and populist relief measures are likely to intensify.

The ruble faces mounting pressure as fiscal stress, inflation, and capital flight converge. At ₽100/USD, soft stress emerges, prompting FX interventions and verbal guidance. A breach of ₽120 signals hard stress, triggering capital controls and export mandates. If the ruble crosses ₽140, Russia may impose dual exchange rates and forced conversions—echoing late-Soviet tactics and risking systemic panic. Simultaneously, opaque fiscal maneuvers and aggressive tax grabs risk provoking new sanctions. Secondary sanctions target financial institutions, tech imports, and sovereign debt deepen isolation, reduce investment, and force further regressive taxation—fueling a vicious cycle of stagnation and policy erosion.

VAT evasion accelerates as rates climb. At 20%, evasion hovers near 15% of taxable activity; at 22%, it breaches 22%, and at 24%, it may exceed 30%. Informal markets, especially in fuel, food, and retail—expand rapidly, undermining revenue and policy credibility. The tipping point arrives when formal compliance collapses and black-market dynamics dominate, forcing Moscow to choose between enforcement crackdowns and politically costly exemptions.

Consumer trust erodes when inflation outpaces wage growth and tax burdens rise without visible returns. Trust thresholds collapse when CPI exceeds 10%, real wages fall more than 5%, and VAT exemptions fail to materialize. At this point, households withdraw ruble deposits, hoard hard currency, and exit formal banking channels. Capital flight accelerates when ruble volatility combines with sanctions risk—especially if sovereign debt access is curtailed. The Kremlin may respond with forced conversions, FX rationing, or digital ruble mandates, but these risk further erosion of domestic confidence and international credibility.