By Rick Clay

China has quietly but aggressively escalated its campaign to acquire gold at a scale rarely seen in modern history. While Beijing’s appetite for bullion is not new, the pace and intensity of its purchases signal a strategic shift designed to rescue the Communist Party from deepening financial crises and to insulate itself from the dominance of the U.S. dollar.

For the Chinese Communist Party (CCP), gold has become both lifeline and weapon. With the yuan weakening to just $0.14 against the U.S. dollar, and systemic pressures mounting from a collapsing real estate sector, regional banking instability, deflationary pressures, and industrial overcapacity, Beijing views gold as the only hard asset capable of stabilizing its financial position.

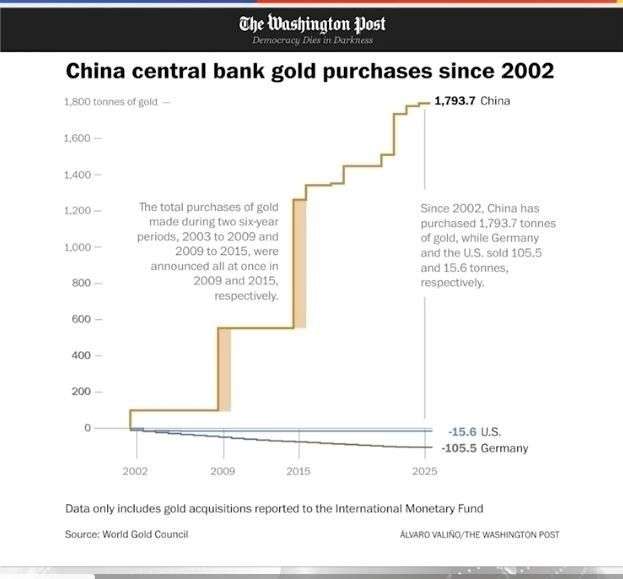

The Scale of the Acquisition

China has been the world’s largest gold producer since 2007 and its largest gold consumer since 2013, but official reserves tell only part of the story.

• By early 2025, the People’s Bank of China (PBoC) reported holdings of 2,285 metric tons of gold, the result of steady monthly additions.

• Independent analysts, however, estimate the real figure may be far higher. According to Money Metals and Asia Markets, covert purchases could push actual holdings above 5,300 tons—more than double official claims.

• Goldman Sachs suggests Beijing’s reported figures understate purchases by at least 60 tons in recent years.

• In 2024 alone, Money Metals argues the PBoC secretly bought 570 tons, five times the official tally.

Even more revealing was a statement from the National People’s Congress, admitting that China’s reserves remain insufficient to sustain its financial system under current pressures.

Why Gold, and Why Now?

Several strategic drivers explain Beijing’s gold obsession:

• Yuan Fragility: With the RMB sliding against the dollar, gold acts as a hedge against depreciation.

• Systemic Pressures: Real estate debt, banking crises, and deflation force Beijing toward hard assets.

• De-dollarization: After Western nations froze Russia’s reserves in 2022, Beijing accelerated efforts to shield itself from similar financial “weaponization.”

This is more than an economic adjustment—it’s preparation for a post-dollar global order.

Covert Gold Operations Abroad

China’s strategy isn’t confined to domestic mining. The CCP has turned to illegal and covert gold extraction abroad, often in fragile states where oversight is weak:

• Ghana: Thousands of Chinese nationals have been deported or arrested for illegal mining (“galamsey”). Reports link Chinese operations to child labor, mercury poisoning, and toxic runoff that has rendered rivers like the Pra, Ankobra, and Offin “unwholesome for treatment.”

• DRC, Nigeria, Papua New Guinea, French Guiana: Similar patterns of covert mining, often accompanied by corruption, weak enforcement, and environmental devastation.

This overseas activity isn’t just about filling China’s vaults—it may represent a broader geopolitical strategy of resource control and environmental leverage.

Implications for U.S. Policymakers

China’s gold rush poses both economic and security risks for Washington and its allies.

• Risk Assessment: Beijing’s hoarding signals preparation for financial decoupling and challenges to dollar dominance. Its covert mining abroad destabilizes regions while securing strategic advantage.

• Policy Levers:

• Expose hidden CCP purchases through forensic trade and reserve audits.

• Support host nations like Ghana and the DRC with anti-corruption tools and environmental remediation.

• Push for greater gold market transparency via the IMF and World Gold Council to counter opaque Chinese reporting.

⸻

Conclusion

For the CCP, gold is more than a safe haven—it is a geostrategic weapon. As Beijing stockpiles bullion at unprecedented levels, its intentions are clear: shore up a fragile yuan, prepare for financial decoupling, and leverage global resources to secure its future.

For the U.S. and its partners, the challenge is equally clear: counter this surge with transparency, enforcement, and strategic resilience before China turns its gold hoard into a fulcrum of global power.