By Tim Frazer

In the dynamic world of global finance, hedge funds are increasingly seeking new bases of operation amid shifting economic landscapes. As of December 2025, destinations like Dubai and Abu Dhabi in the UAE, along with Switzerland, are attracting a wave of relocations from traditional centers such as London and Paris. This trend is fueled by a combination of attractive incentives in these emerging hubs and growing disincentives in established markets, including tax hikes and regulatory pressures. With billions in assets on the move, this migration signals a potential reshaping of the industry.

The United Arab Emirates, particularly Dubai and Abu Dhabi, has positioned itself as a premier destination for hedge funds through a blend of fiscal advantages, regulatory ease, and lifestyle appeal. The absence of personal income tax in the UAE allows fund managers and traders to maximize their earnings, a stark contrast to the rising tax burdens elsewhere. Additionally, the region’s sovereign wealth funds, managing over $1.1 trillion in assets, provide hedge funds with unparalleled access to capital for deployment and partnerships. Regulatory frameworks in free zones like the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) are tailored to foster innovation, offering streamlined processes and English common law systems that facilitate quick setups. Lifestyle factors also play a significant role: world-class infrastructure, safety, international schools, and a vibrant expatriate community make relocation appealing for professionals and their families.

Notable examples include Man Group Plc, the world’s largest publicly traded hedge fund, and Oak Hill Advisors, which are among those flocking to the UAE. Even non-hedge fund figures like Revolut Ltd.’s CEO Nikolay Storonsky have shifted residence to the Middle East, underscoring the region’s broad allure. Abu Dhabi’s “hedge fund island” is expanding with a $16 billion plan, further cementing its status as a hub.

Switzerland continues to draw hedge fund talent with its long-standing reputation for political neutrality, strong privacy protections, and competitive tax regimes. Cantons like Geneva and Zug offer corporate tax rates often below 15%, along with personalized tax arrangements for high-net-worth individuals. Recent developments, such as income tax cuts to boost competitiveness and the rejection of a 50% inheritance tax on the super-rich in November 2025, enhance its attractiveness.

The country’s regulatory stability provides a safe haven amid global uncertainties, allowing seamless access to European markets without the full weight of EU regulations. This environment is particularly appealing for managers seeking predictability in an era of volatile policies elsewhere.

A prime example is Alan Howard, co-founder of Brevan Howard Asset Management LLP (founded in 2002, with Howard’s net worth at $4.3 billion), who became a Swiss resident in early June 2025 after leaving the UK. Howard previously worked from Geneva for seven years before returning to the UK in 2017 for personal reasons, but has now relocated again, likely drawn by tax advantages and stability. Other moves include Jeremy Coller to Switzerland and the Livingstone brothers to Monaco, reflecting a wider exodus of wealthy individuals.

The relocations are not solely about the attractions of Dubai and Switzerland; they are also reactions to challenges in legacy financial centers. In the UK, the Labour government’s policies— including higher taxes on private equity investments, inheritances, and capital gains, as well as the end of the non-dom tax regime in April 2025—have prompted an outflow of talent. Former Prime Minister David Cameron has warned of a potential exodus to Dubai and Abu Dhabi amid these changes.

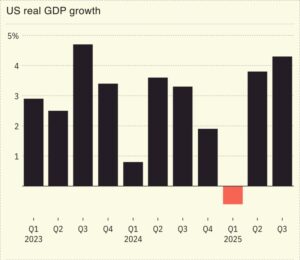

Data reveals a net emigration of 110,000 British people aged 16-34 in the year to March 2025, with many heading to Middle Eastern destinations. Similarly, France’s high fiscal spending and debt issues are driving billionaires away, contributing to a weak white-collar job market in Europe. These pressures are accelerating the shift, as hedge funds seek environments that better support growth and retention of top talent.

This migration underscores a global realignment in finance, where agility and optimization trump tradition. With hedge funds managing trillions in assets relocating, Dubai and Switzerland are poised to innovate and expand their financial ecosystems, potentially pressuring older hubs to reform. For the industry, it’s a strategic pivot toward efficiency, capital access, and quality of life in a post-pandemic era marked by economic flux. As policies evolve, the flow of “smart money” to these destinations may only intensify.