By Bill Michael

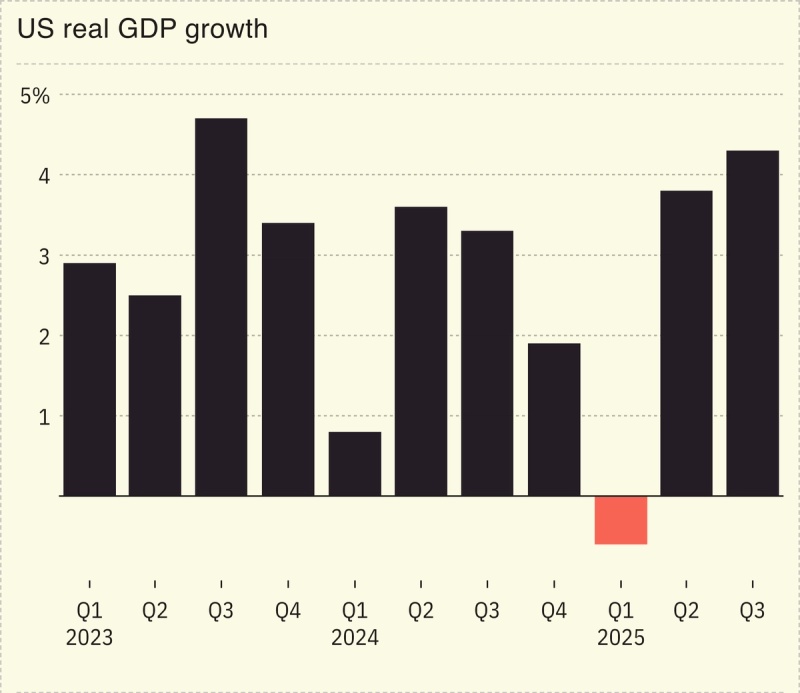

The US economy expanded at an annualised rate of 4.3 per cent in the third quarter, surpassing economists’ expectations and marking the strongest growth in two years, according to delayed official data released this week.

The Bureau of Economic Analysis reported that real gross domestic product accelerated from a 3.8 per cent pace in the second quarter, driven primarily by resilient consumer spending amid ongoing trade distortions and policy uncertainties.

The figure, which exceeded consensus forecasts of around 3.3 per cent, was boosted by a sharp rebound in exports and a continued decline in imports — the latter subtracting from GDP calculations but reflecting front-loading ahead of tariff implementations earlier in the year.

Consumer spending, the backbone of the US economy, rose at a 3.5 per cent annualised rate, up from 2.5 per cent in the prior quarter. This strength came despite signs of a cooling labour market and elevated inflation pressures.

Government expenditure also contributed positively, increasing 2.2 per cent, supported by defence outlays and state and local spending. Corporate profits surged by more than $166bn, underscoring robust business conditions in certain sectors.

However, private investment softened, with declines in residential and non-residential structures offsetting gains in intellectual property products — a category that includes significant AI-related developments.

The report highlights a persistent “K-shaped” recovery, where higher-income households continue to drive demand, particularly in services and durable goods, while lower- and middle-income consumers face mounting pressures from higher borrowing costs and stagnant real wage growth in some areas.

Inflation metrics within the GDP data showed an acceleration, with the price index for gross domestic purchases rising 3.4 per cent — the quickest pace since early 2023. This uptick may influence the Federal Reserve’s deliberations on future rate adjustments, especially as core personal consumption expenditures remain above target.

Looking ahead, economists anticipate a slowdown in the fourth quarter, potentially to around 2 per cent or lower, weighed down by the recent 43-day government shutdown and lingering effects of trade policies. The shutdown has already delayed further data releases, complicating real-time assessments.

Despite these headwinds, the third-quarter outperformance underscores the underlying resilience of the US economy, powered by consumer tenacity and productivity gains in technology-driven sectors.

This delayed initial estimate replaces what would have been advance and second readings, with a final revision expected early next year.